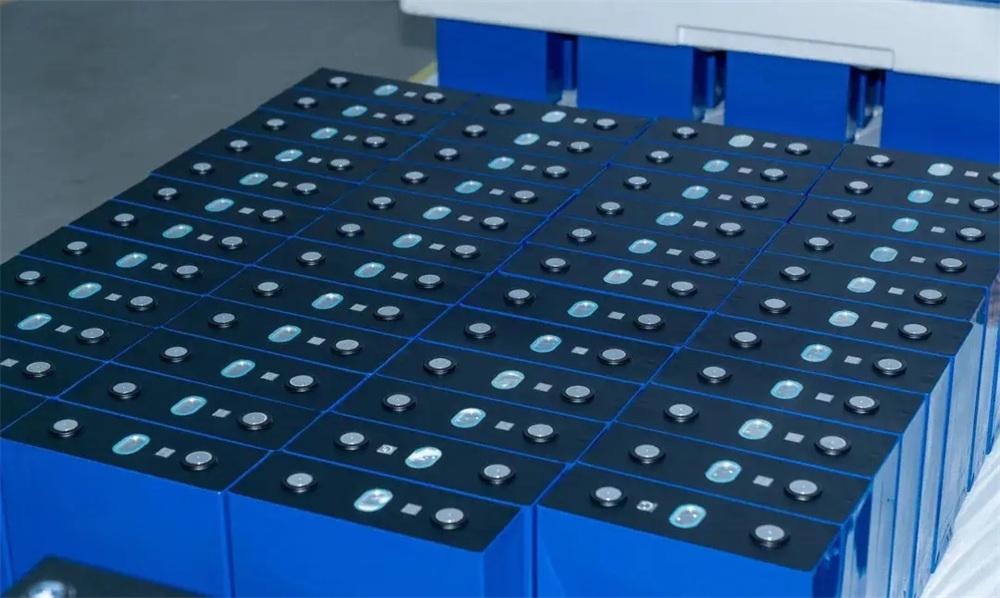

January 2026 — The global energy storage industry has officially entered a new phase of gigawatt-level competition. The sector is currently undergoing a critical technological iteration: large-capacity Lithium Iron Phosphate (LFP) cells exceeding 500Ah are shifting rapidly from pilot validation to full-scale mass production. In this industrial transformation, Chinese lithium battery enterprises have emerged as the absolute dominant force.

Leading players such as CATL, EVE Energy, and Hithium have successfully completed mass production deliveries and capacity ramp-ups. Meanwhile, second-tier contenders like Envision AESC and CALB are accelerating product launches. A comprehensive matrix of large-format cell products has taken shape, restructuring the product landscape and extending China’s competitive edge from electric vehicles (EVs) to the energy storage sector through superior technology, capacity, and supply chain integration.

Data indicates that cumulative shipments of domestic 500Ah+ storage cells exceeded 5GWh in 2025. Notably, over 90% of these orders were destined for overseas markets, marking these high-capacity cells as the new spearhead of China’s lithium export strategy.

The explosion of the large-cell race is not accidental but a necessary evolution of the global industry. As renewable energy integration demands rise and long-duration energy storage policies take effect, traditional 280-314Ah cells can no longer meet the requirements for high integration, low cost, and high energy density in containerized storage systems. Consequently, the 500Ah+ cell has become the industry consensus for upgrades.

The commercial logic rests on system-level cost reduction:

Reduced Complexity: A single containerized system requires 60% fewer cells.

Cost Savings: Costs for structural components—such as connectors, welding points, and sampling channels—are cut by 15-20%.

Efficiency Gains: Assembly efficiency improves by 30%, while system energy density increases by over 25%.

Leveraging over a decade of experience in the EV battery sector, Chinese manufacturers have rapidly translated their expertise in materials, processes, and quality control into advantages for the storage track, laying a solid foundation for the deployment of 500Ah+ cells.

Leading lithium enterprises have established a differentiated competitive landscape, achieving both mass production delivery and capacity ramping.

CATL: As the frontrunner, CATL’s 587Ah cell utilizes advanced winding processes and modified materials to achieve a volumetric energy density of 434Wh/L and a cycle life exceeding 10,000. Its Jining facility boasts a 60GWh annual capacity. following initial deliveries in June 2025, cumulative shipments exceeded 2GWh by December.

EVE Energy: EVE entered the long-duration market with its 628Ah "Mr. Big" cell, achieving mass production in December 2024 at its Jingmen base. Its accompanying "Mr. Giant" system has been deployed in a 400MWh independent storage station and secured a massive 2.2GWh long-term order in Australia.

Hithium: Adopting a dual-track strategy, Hithium mass-produced both its 587Ah ∞Cell and the ultra-large 1175Ah cell (designed for 8-hour+ storage) in 2025. The company has signed system supply agreements exceeding 6.5GWh with European and Israeli firms.

Sunwoda Energy: Coming from behind, Sunwoda produced its 1 millionth 684Ah cell just three months after starting mass production in September 2025. It set a new industry record with a volumetric energy density of 440Wh/L, targeting commercial and utility-scale scenarios.

Beyond the giants, China’s second-tier battery makers have fully positioned themselves in the 500Ah+ race, creating the world’s only complete supply chain for large-capacity LFP cells.

Envision AESC: Launched a 530Ah cell in April 2025, designed for 6MWh+ containerized BESS, achieving "mass production for immediate export."

CALB: Incorporated 588Ah and larger specs into its ultra-long-life roadmap, with shipments slated for early 2026.

REPT Battero: Its 587Ah Wending® cell achieved 430Wh/L density, leveraging EV battery manufacturing experience for rapid ramp-up.

Emerging Players: Companies like Cornex have introduced 588Ah products, initiating phased production plans.

From cathode materials to cell manufacturing and system integration, Chinese enterprises now cover every link of the 500Ah+ value chain.

The scalability of 500Ah+ cells relies on breakthroughs in materials, processes, and thermal management, with "automotive-grade" technology transfer serving as the key catalyst.

Materials: High-compaction density LFP materials have been modified through ion doping and micro-nano design to boost density and cycle life.

Processes: Advancements in stacking and winding technologies allow top-tier firms to control single-cell defect rates at the PPB (parts per billion) level.

Safety & Thermal Management: Technologies matured in the EV sector—liquid cooling, Battery Management Systems (BMS), and multi-level safety protection—have been optimized for storage. This addresses the thermal uniformity challenges inherent in large cells, making 10,000+ cycle lifespans the new industry baseline.

Exports are the primary growth driver for 500Ah+ cells. To address the pain point of fragmented specifications, Chinese firms are adopting an "Integrated Cell-System-Solution" model.

Data shows that of the 20GWh+ in disclosed 500Ah+ orders in 2025, over 90% came from overseas. Europe, the Middle East, and Australia are critical markets where rapid renewable installation is driving demand for 4-hour+ long-duration storage—a perfect match for large cell capabilities. By delivering complete systems rather than just components, companies like CATL and Hithium are transitioning from suppliers to comprehensive solution providers.

Despite the momentum, the industry faces three core hurdles in 2026:

Thermal Safety: Higher energy density increases heat release during faults, demanding advanced liquid cooling and intelligent BMS.

Manufacturing Consistency: Large electrodes make uniform coating and drying difficult; maintaining consistency across voltage and capacity remains a test of process control.

Standardization: The coexistence of various specs (530Ah, 587Ah, 628Ah) complicates design and certification for integrators.

Looking ahead, industry analysts predict that competition will shift from raw capacity to comprehensive technical capability. Specification convergence is expected, with 587Ah likely becoming the global mainstream standard. Furthermore, the "EV-Storage Synergy" will deepen, with flexible production lines and stable supply chains becoming the ultimate deciders of market leadership.

In 2026, the 500Ah+ large cell is not just a product; it is the strategic tool with which China is upgrading its role from a product exporter to a global technology standard-setter in the race toward carbon neutrality.

Contact Person: Miss. Elsa Liu

| WhatsApp : | +8617763274209 |

|---|---|

| Skype : | +8617763274209 |

| WeChat : | 17763274209 |

| Email : | Elsa@lifepo4-battery.com |