Market Overview

The European Union’s battery energy storage market staged a robust recovery in 2025, marked by a significant acceleration in growth rates. The sector has entered a new developmental phase, now decisively dominated by large-scale, grid-tied battery storage systems.

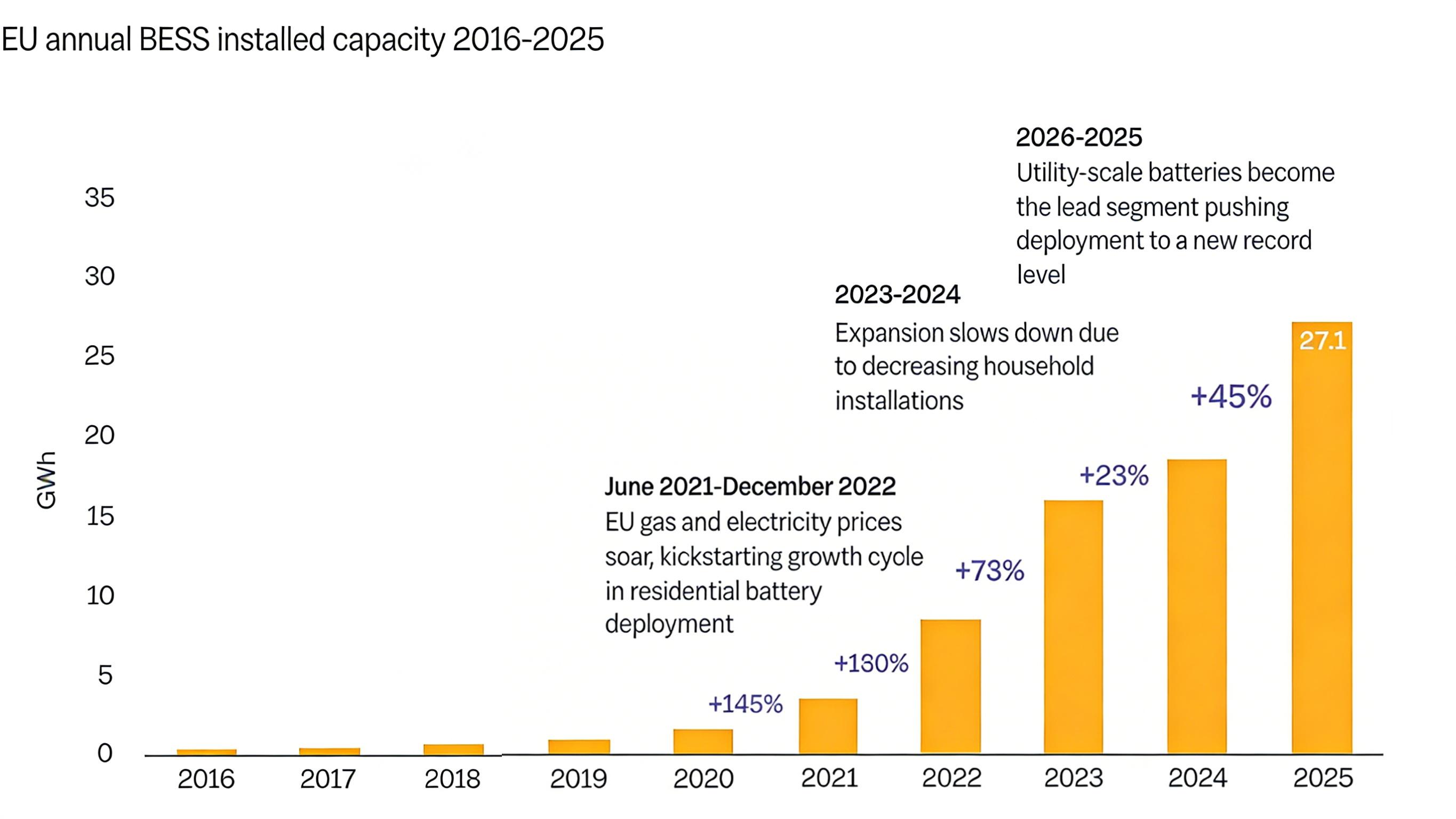

In 2025, the EU installed 27.1 GWh of new battery energy storage systems (BESS), marking the 12th consecutive year of record-breaking growth since SolarPower Europe began tracking the data in 2013. By the end of the year, total operational capacity reached 77.3 GWh. As anticipated, following a temporary slowdown in 2024, the market returned to a high-growth trajectory, with annual installation capacity jumping 45% year-on-year.

Outside the EU block, the UK market rebounded strongly, adding 5 GWh of new capacity in 2025 to bring its cumulative total near 16 GWh. Supported by a solid policy framework and favorable market conditions, Europe’s largest utility-scale storage operators are making significant strides toward their 2030 targets.

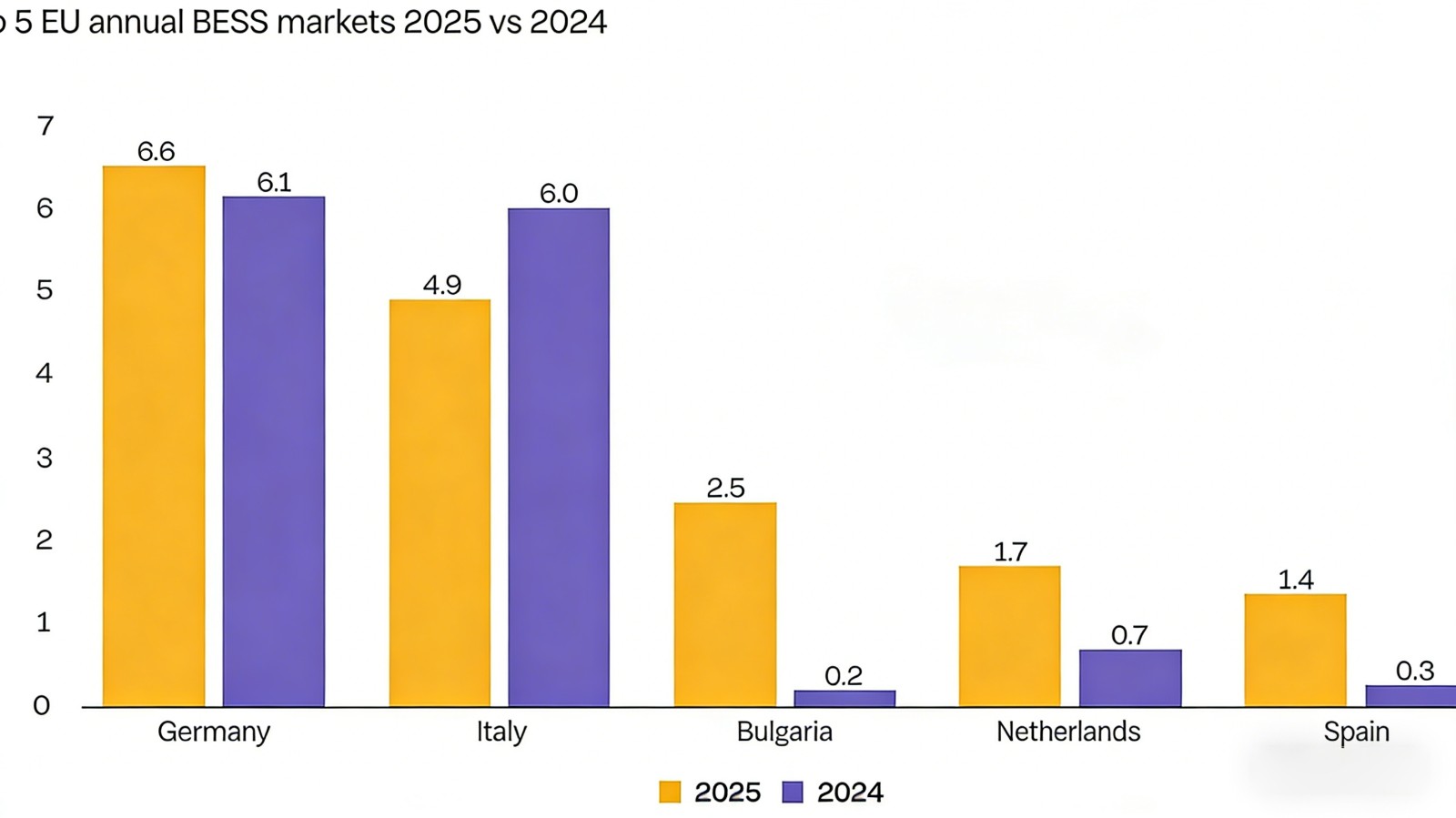

Top 5 Markets Drive Over 60% of New Capacity

Germany and Italy continued to lead the EU battery storage landscape in 2025. However, Bulgaria emerged as the year’s breakout market, surging to third place, with the Netherlands and Spain rounding out the top five.

The barrier to entry for the top tier has risen significantly: massive deployment of utility-scale storage is now the key differentiator, with gigawatt-hour scale deployments becoming the minimum requirement for leadership.

Germany retained its top spot, driven by record-breaking large-scale installations and resilient commercial and industrial (C&I) growth, despite a moderate dip in the residential sector.

Italy saw steady utility-scale expansion, though total annual additions declined due to a sharp contraction in residential installations.

Bulgaria became the year's dark horse, achieving breakthrough development fueled by strong market incentives and an explosion of large-scale projects.

Netherlands secured fourth place through balanced growth across all three market segments, aided by improved policy and market environments.

Spain entered the top five by deploying storage systems on a larger scale, officially designating storage as a strategic asset for energy transition and optimizing framework conditions to accelerate adoption.

In 2025, these top five markets accounted for 63% of the EU’s new installed capacity. This represents a shift from 2024, when the top five (then Germany, Italy, Sweden, Austria, and Netherlands) held nearly an 80% share. While the market share of leading nations has diluted, the geographic concentration of deployment remains relatively high.

Supply Chain Expansion Amidst Lingering Uncertainty

Europe has developed a functional midstream battery industry, though it retains vulnerabilities in upstream mining and refining. Production capacity for electrolytes (345 GWh equivalent/year) and separators (220 GWh equivalent/year) is ample, whereas production of cathode active materials (52 GWh) and anode active materials (3 GWh) remains remarkably limited.

At the cell level, heavy investment has created a potential manufacturing capacity of 252 GWh, yet the industry’s future trajectory faces uncertainty. Meanwhile, Europe possesses substantial capacity for battery pack and module assembly—nearly half of which is located in Germany—though less than 20% of this capacity currently serves the stationary storage market.

Strategic Recommendations

Industry analysts highlight three critical pathways to sustain this momentum:

1. Accelerating BESS Deployment

Streamline permitting and approval processes.

Prioritize grid-friendly assets in connection queues.

Establish fair, cost-reflective tariff mechanisms.

Unlock market access and diversify revenue streams.

Strengthen cybersecurity frameworks.

2. Building an Affordable, Resilient Supply Chain

Foster trade liberalization and strategic partnerships.

Incentivize domestic EU production.

Secure access to critical raw materials.

Drive research, development, and innovation.

3. Enhancing Quality, Safety, and Sustainability

Harmonize safety and quality standards across the region.

Optimize recycling processes and raw material recovery.

Reduce the carbon footprint across the entire product lifecycle.

Next:The Evolution of Prismatic Aluminum Shell Battery Cell Dimensions (2010-2026)

Previous:CATL & Ellen MacArthur Foundation Unveil Battery Roadmap

Contact Person: Miss. Elsa Liu

| WhatsApp : | +8617763274209 |

|---|---|

| Skype : | +8617763274209 |

| WeChat : | 17763274209 |

| Email : | Elsa@lifepo4-battery.com |